- Like Collect Share

-

0 0

- Category: Personal Finance

- Published by: Nestingen Inc. ?

- Size: 10.2 MB

-

Permissions:

- Access your Internet connection

- Supported processors: x86, x64, ARM

- Language: English (United States)

- Learn more:

-

Notes:

* Release 7 Mortgage Miser Upgraded to Windows 8.1 Release 6 Fixe numeric field bug. There was an issue when entering number where the cursor would more unexpectedly to the left side of the field after entering the first number. Release 5 Include An In-depth description of the purpose of each field Fixed a bug with adding a loan after renaming Auto Recalculates Mortgage after changing field values Change Open Schedule icon to button with text label Release 4 Includes Improvements of the validation Reorganizing the UI layout with all ARM feature on the right Release 3 Includes Added Extra Fees Added Prepayment Added Additional Features button to App Bar Added Demo button to App Bar Release 2 Includes Added Formatting to the Grid Schedule. Improved Mortgage Term tool tip to tell the user the number of years Added link to Demo Video

Mortgage Miser

Description

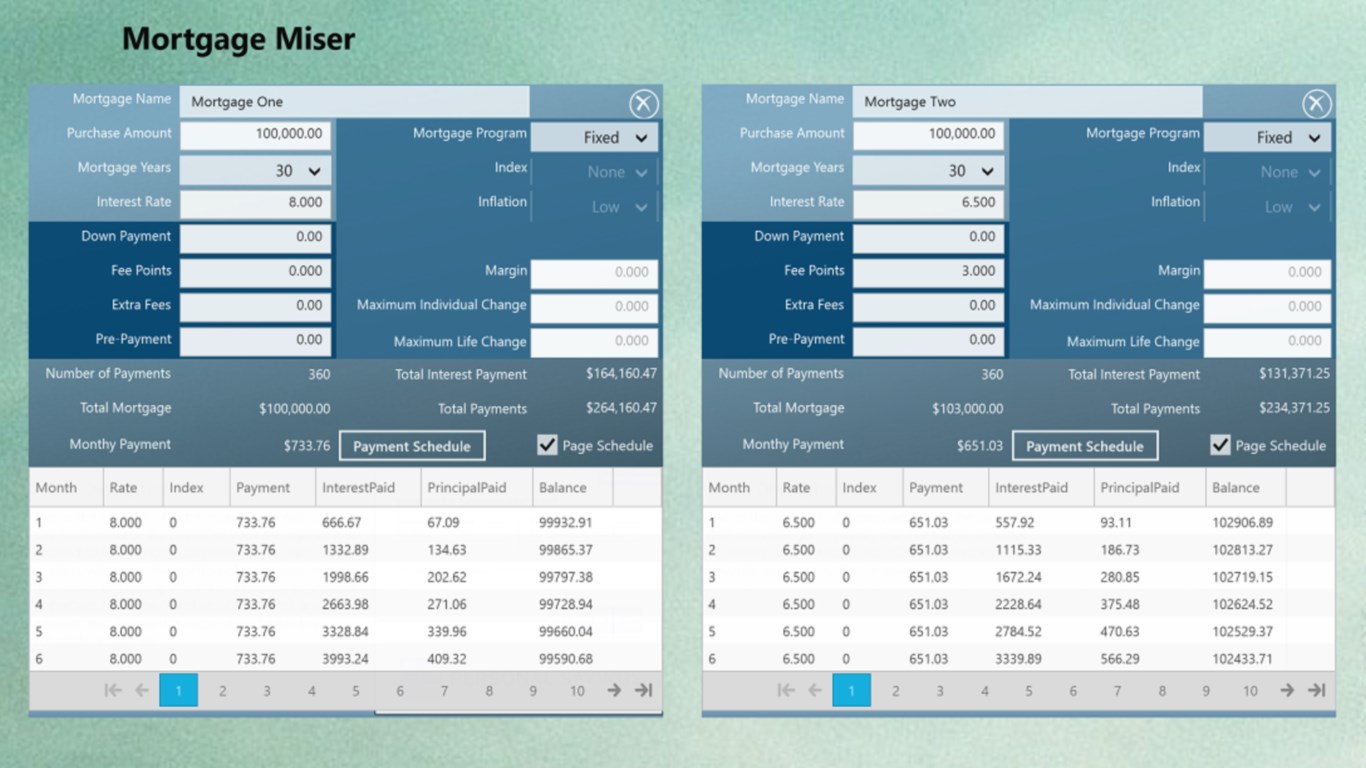

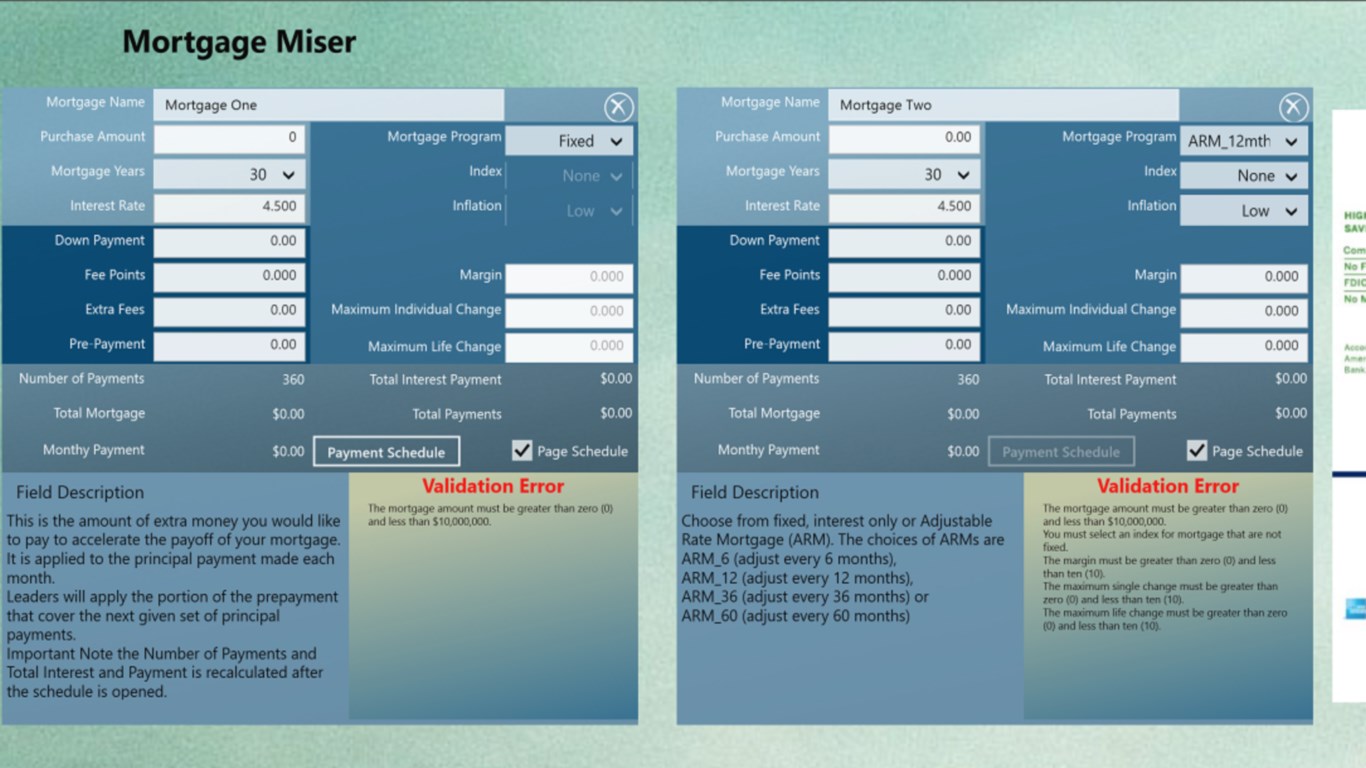

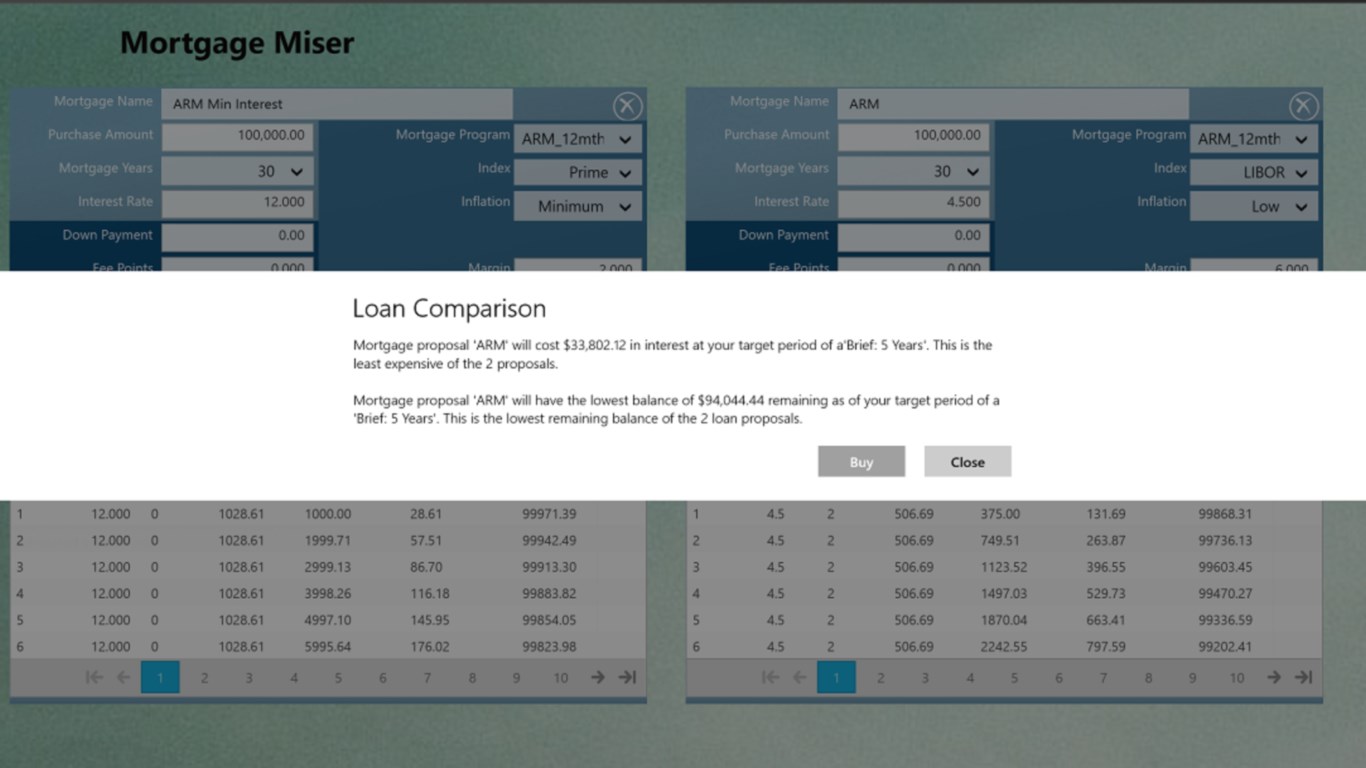

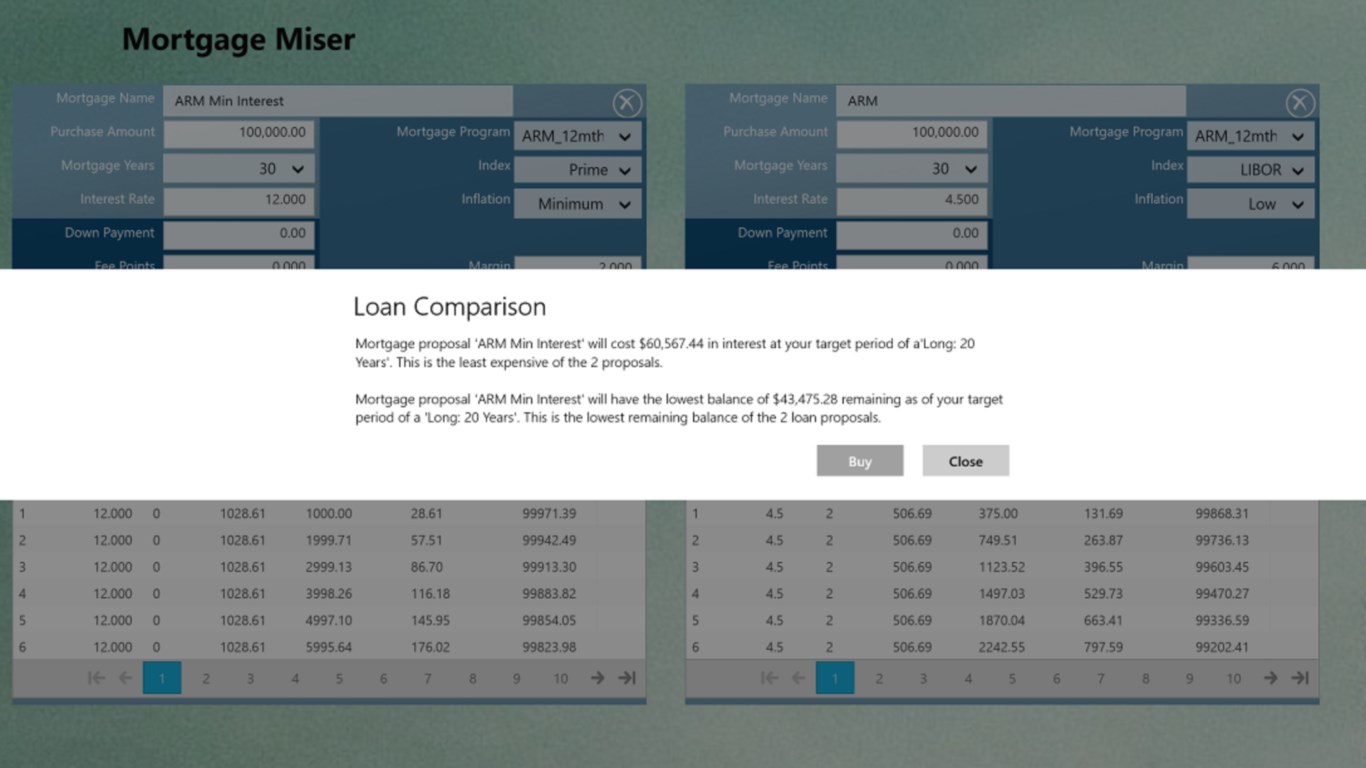

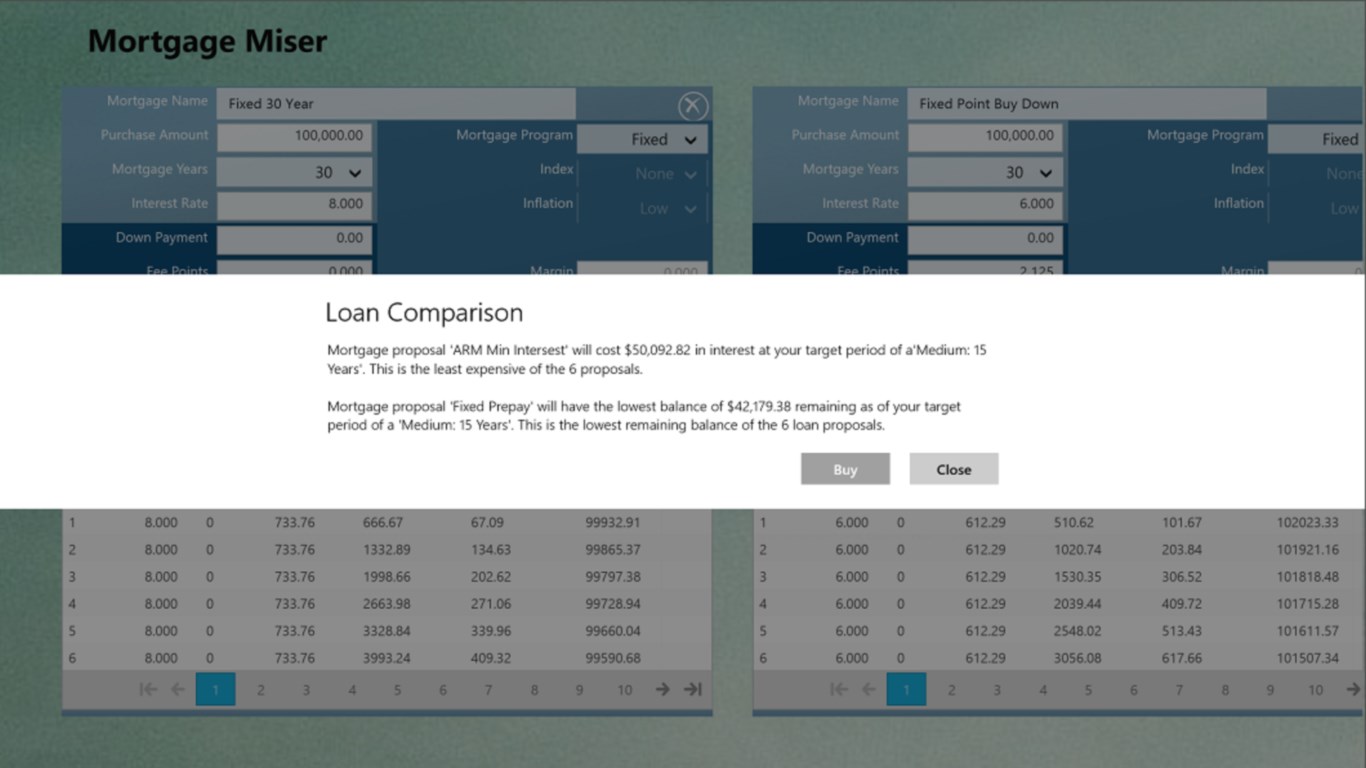

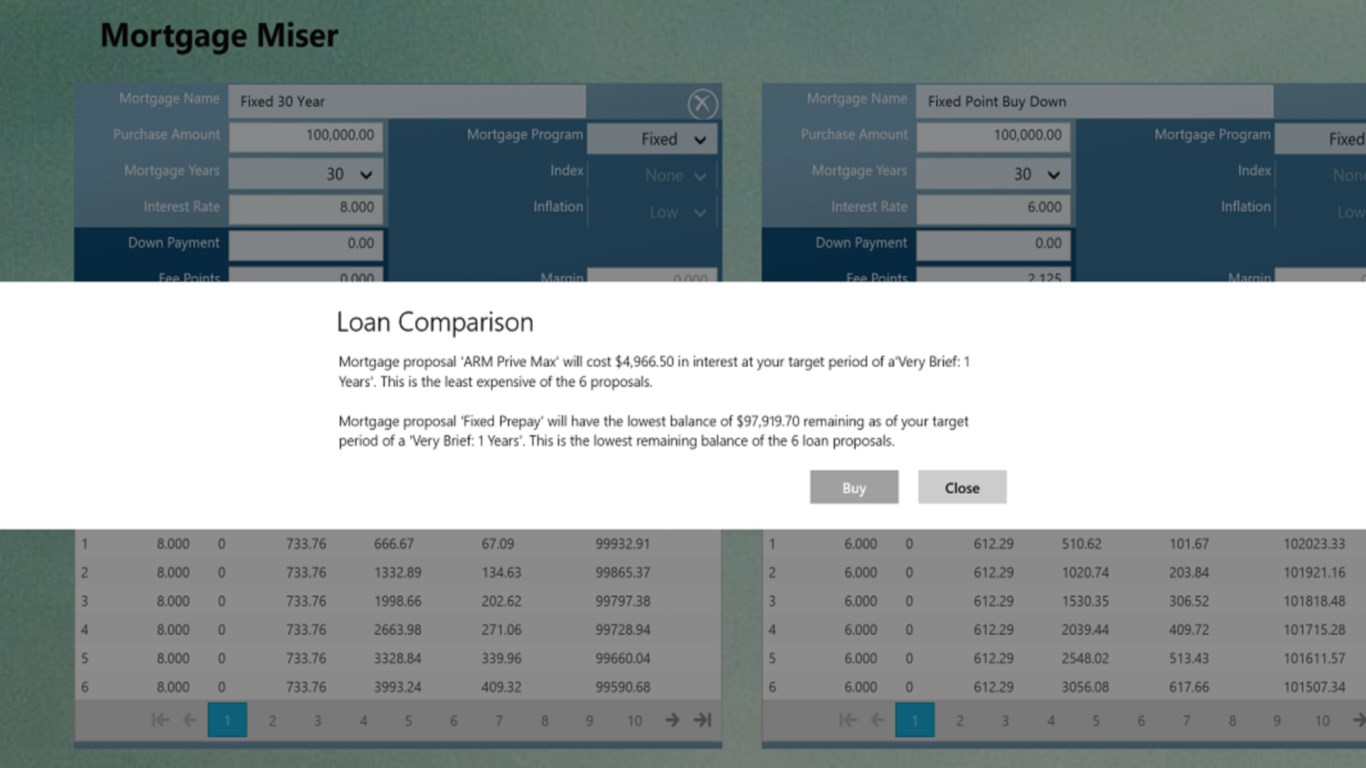

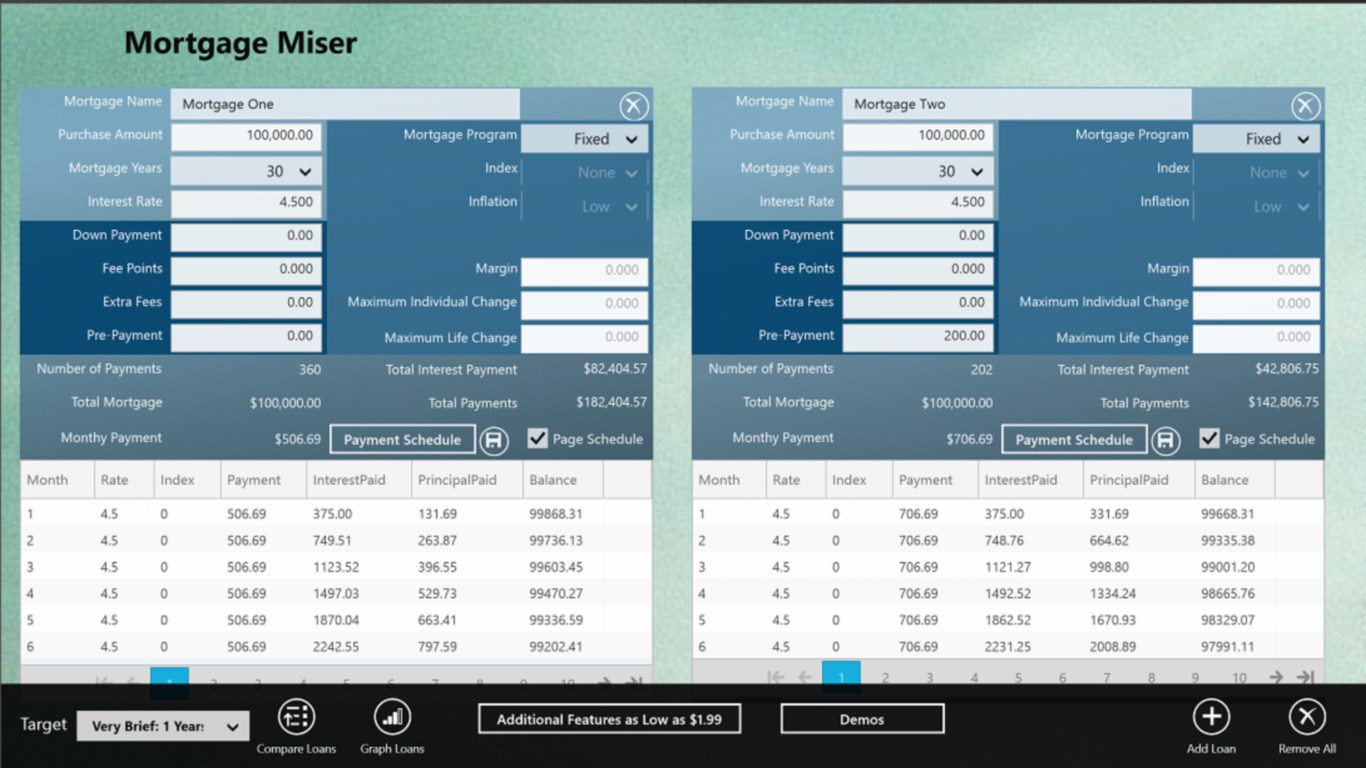

Mortgage Miser provides a graphic and narrative side-by-side comparison of consumer loans including home mortgages or auto loans. Mortgage Miser compares ARM, fixed rate or interest-only loans. ARM loans can adjust with (4) time parameters. Four (4) historical indexes can be used to calculate the interest change including the Prime, LIBOR, 11 Dist COR, and 1 year CMT. Down payments and points can be included to determine the final cost of the loan.

Once a user inputs the loan amount, term, and interest rate, Mortgage Miser provides the (EMI ) and detailed monthly payment schedule for the term of the loan. Users can enter up to six (6) loans for side-by-side comparison. The schedule will show monthly payments, accumulated interest, and a breakdown of the decreasing principal amount.

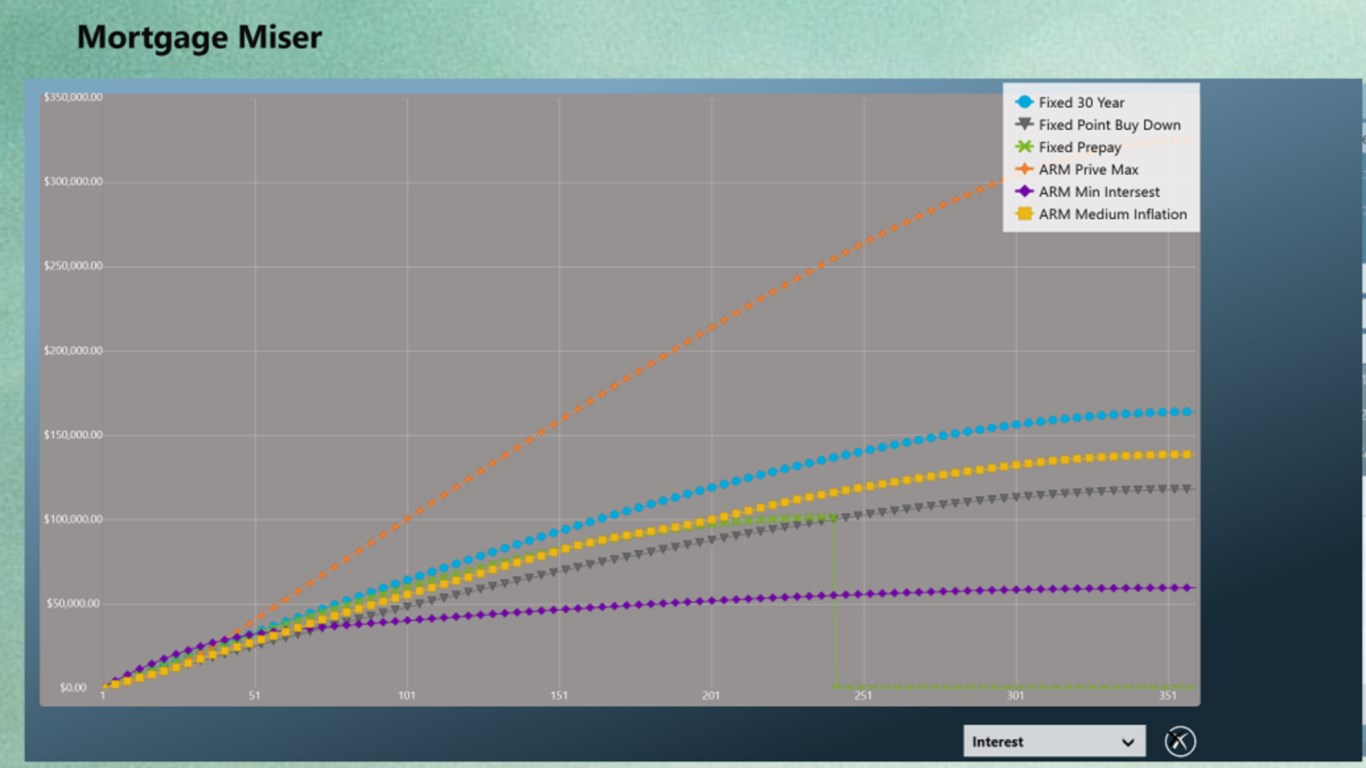

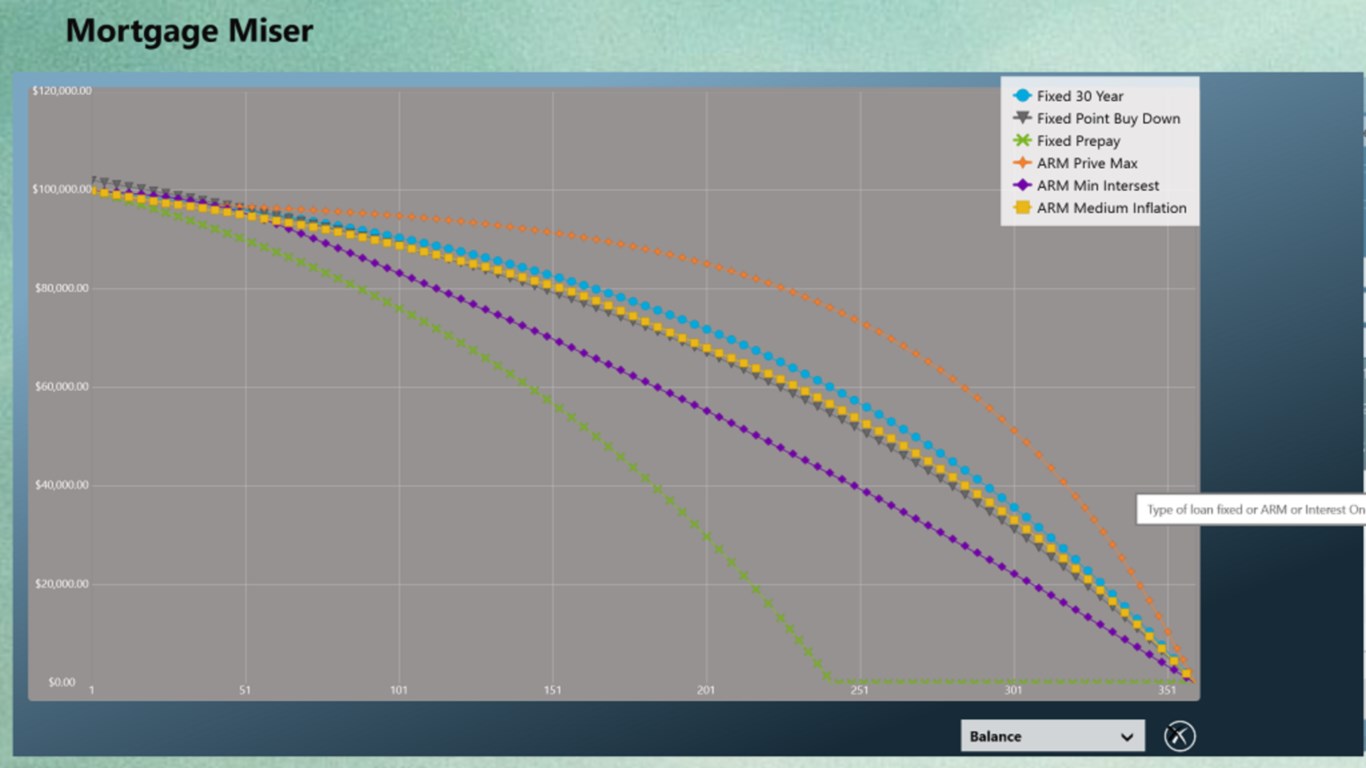

Mortgage Miser generates a detailed payment schedule and users can view a colorized graph that displays the accumulated interest or balance for each of the loans. A narrative assessment is also provided to help consumers choose the most cost effective loan given the different loan parameters.

There are four variation to the program.

•Free: Free with ads and allows you to compare two mortgages simultaneously.

•Basic: No ads and allows you to compare two mortgages simultaneously and share.

•Professional: Compare as many as 6 loans simultaneously for $8.99 with no ads and share.

•Advanced: Compare as many as 6 loans simultaneously for $8.99 with no ads, share and save to excel.

•Renew: One more year at Advanced

Features

•Compares mortgages Graphically or Narratively

•ARM mortgage calculator

•Prepayment

•Extra-Fees

•Four Adjust time choices

6 months

12 months

36 months

60 months

•Four historical indexes plus a maximum and minimum interest

Prime

LIBOR

11 Dist COR

1 Year CMT

•Five Inflation skew

Low

Medium

High

Minimum

Maximum

•Margin

•Maximum individual Change

•Maximum Life Change

•Round ARM adjustment to the nearest one eighth of a percent

•Include a down payment or points

•Fixed rate mortgage calculator

KEY Words

•Mortgage

•Loan

•House

•Adjustable Rate Mortgage

•Real-estate

•Relator

•Lending

Versions:

•Free Advertisement compare only two loan

•Basic: No Advertisement compare only two loan for $1.99

•Professional: No Advertisement and compare six loans for $8.99

•Advanced: No Advertisement and compare six mortgages and save to excel for $19.99

Using Infragistics Controls for the grid, graph and numeric controls

Features:

- Compares mortgages Graphically or Narratively

- ARM mortgage calculator

- Four Adjustment time choices

- Four historical indexes plus a maximum and minimum interest

- Fixed rate mortgage calculator

- Interest Only

- Includes a down payment or points

- Include a Prepayment

- Include the cost of extra fees

- An In-depth description of the purpose of each field

Similar Apps View all

Comments View all

2 comment

30 August 2013

I was overwhelmed with the decision I needed to make when shopping for a home loan - fixed? ARM? length? This APP was perfect in helping me to make the biggest purchase in my life....and now I feel at ease that I made the right choice. Thanks Mortgage Miser!

28 August 2013

This app is extremely helpful. It helped me determine which of two mortgages would be best for me financially. This app allowed me to discover the advantages of pre-payment.