- Like Collect Share

-

0 5

- Category: Personal Finance

- Published by: Gaier Software LLC ?

- Size: 1.3 MB

- Supported processors: x86, x64, ARM

- Language: English (United States)

- Learn more:

-

Notes:

* New Features added for version 2: * Printing Transaction Views * Backup/Restore * Export Transactions * New Loan Calculator * Interest Rate Change Icons in Transaction View

Debt Tracker

Features:

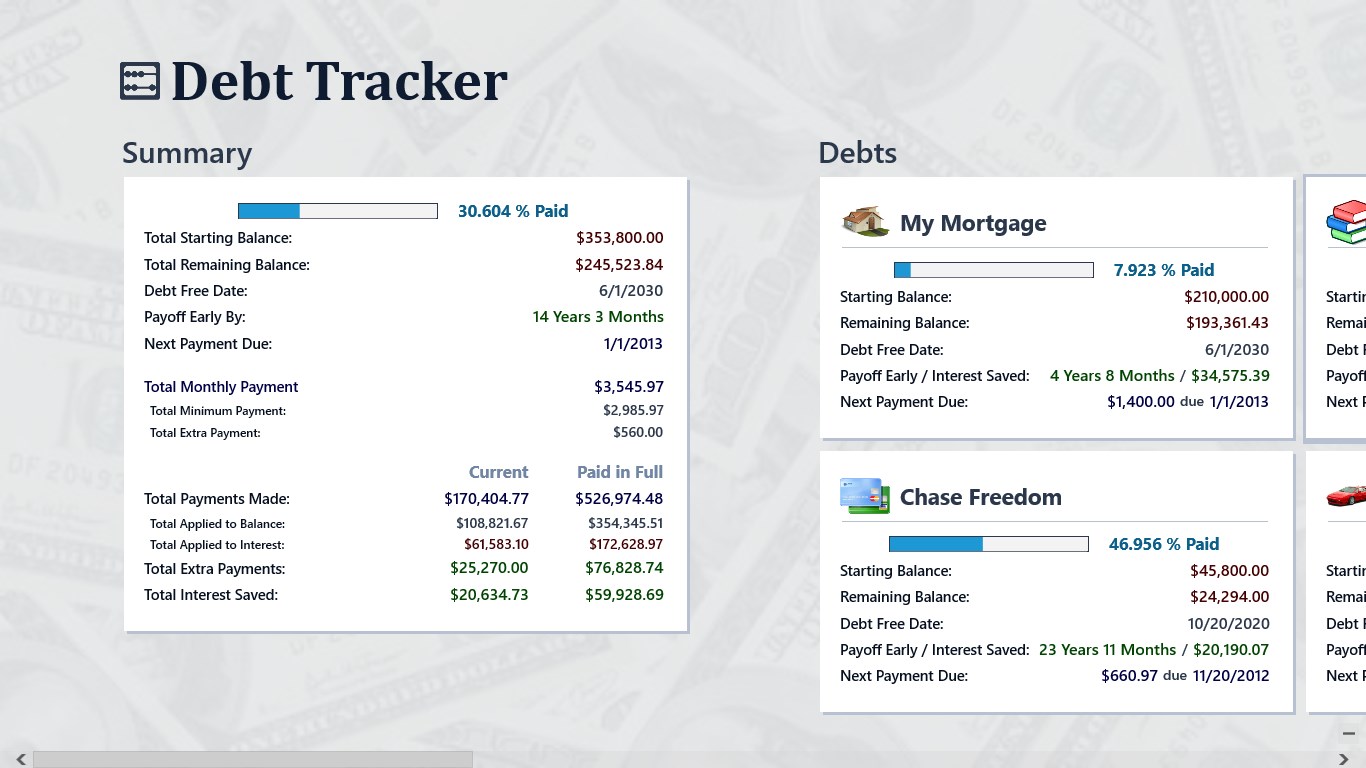

- With minimal input Debt Tracker will setup a standard payment schedule as a starting point, and from there you are in total control.

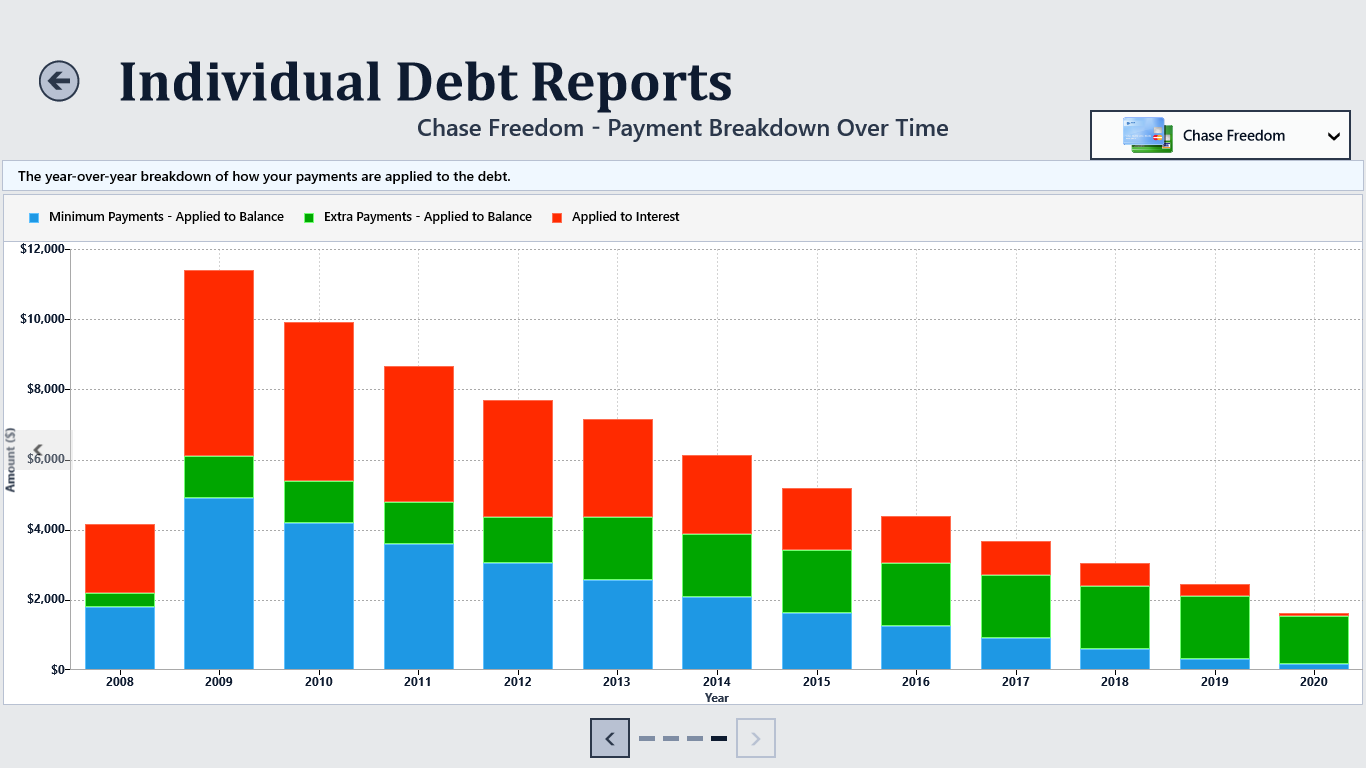

- Each month you can quickly record the standard payment, or edit the payment info before recording.

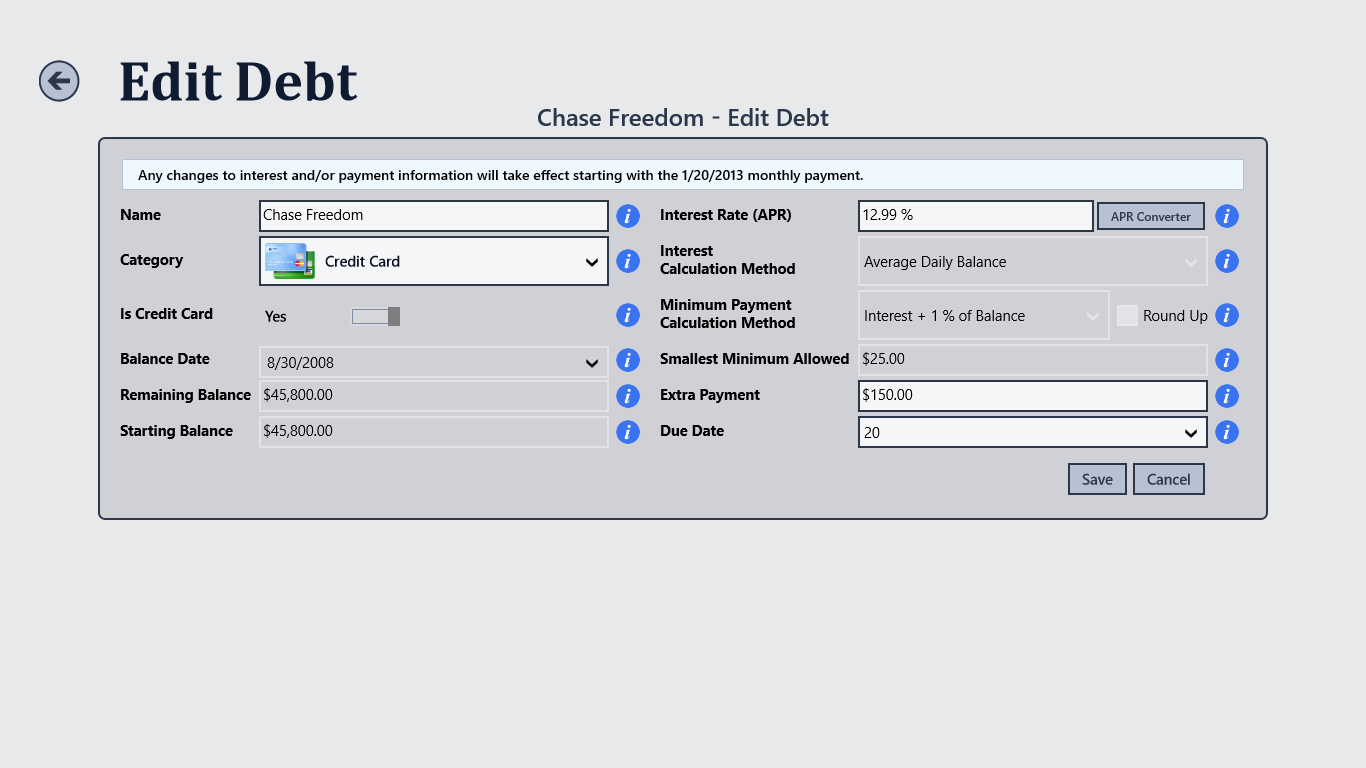

- Edit interest rate, minimum/extra payments as you progress through the payment schedule to support scenarios like variable interest rates, changing extra payment amounts as your budget changes.

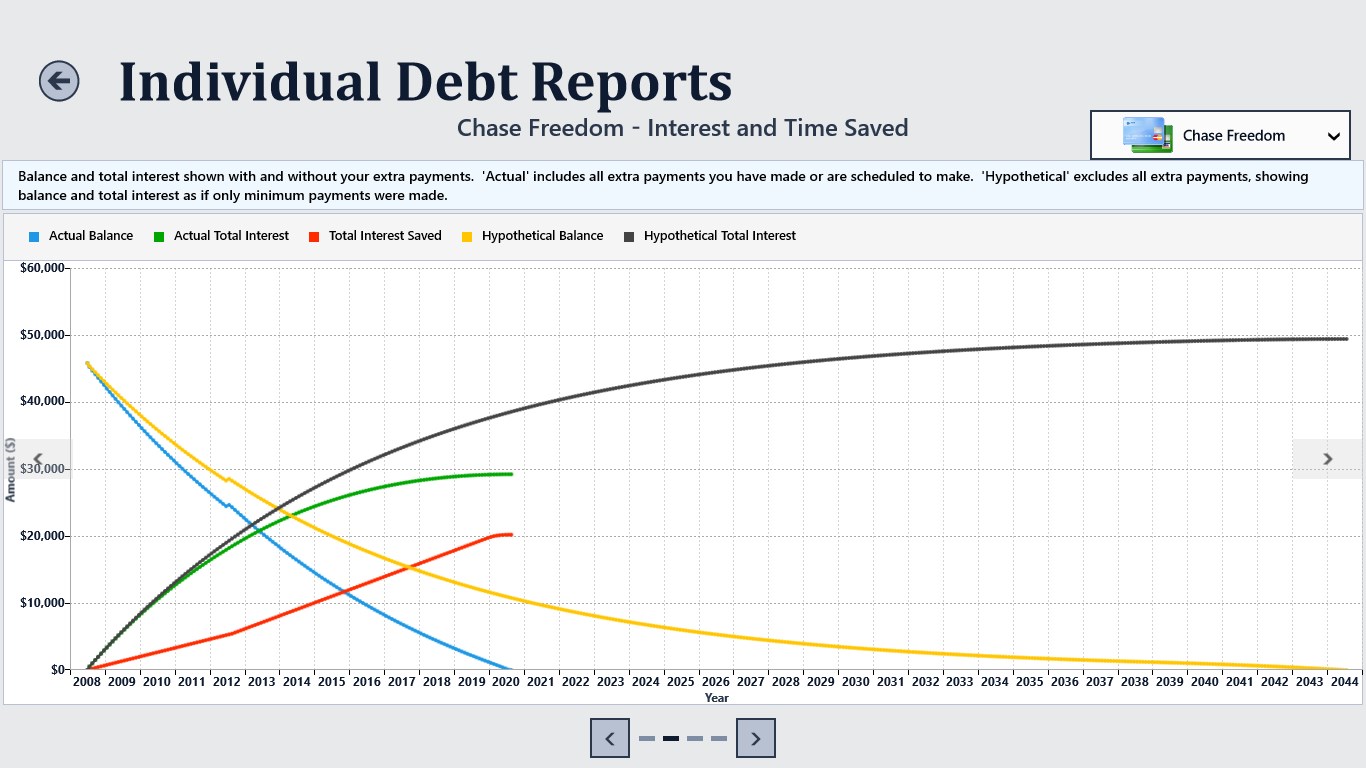

- Add future or one-time extra payments, allowing you to try out “what if” scenarios to see how much you could save.

- Add balance adjustments, or purchase/credit transactions to keep Debt Tracker up to date and accurate.

- For mortgages/loans, Debt Tracker supports standard monthly compounded interest, along with daily and semiannual compounding (e.g. Canadian Mortgages).

- For credit cards, Debt Tracker goes way beyond typical debt tools available today by supporting the actual calculation methods creditors use to determine monthly interest and minimum payments.

- Ultimately this means you don’t have to hassle with entering these values each month and instead Debt Tracker will compute them for you along with more accurate interest savings projections.

Similar Apps View all

Comments View all

40 comment

9 May 2017

I would have loved this app if I could get it to download. I have tried several times but it never wants to finish and no it is not my internet. Anyway, good concept bad app.

30 March 2017

You can change how much your paying monthly and see how much you would actually pay and how much of your loan would get shortened

31 December 2016

For the average person this does beyond what you would expect!! Good job

2 December 2016

I've been keeping track of this information in an Excel spreadsheet, but after downloading the trial for this software I ended up buying it because it does a lot of the calculations for you.

4 October 2016

good for keeping track. wish it was like Quicken where it updates your stats everytime something is used

30 September 2016

I JUST GOT THIS APP, AND HAVE NOT USED ALL ITS OPTIONS, BUT I WLL REVIEW IT DOWN THE LINE AGAIN. SO FAR SO GOOD

28 September 2016

I like what I see but I haven't learned to move around smoothly yet. I don't see how to show changes such as additional spending on credit cards. Pat

17 September 2016

Able to make proper changes, user friendly. With will-power you can watch the debt dwindle, making way for savings!

7 April 2016

It's easy enough to use and has a simple interface but it needs a 0% interest option and it won't allow you to enter individual extra payments for each month should you choose to

4 April 2016

helped me breakdown all my debts owed and figure out which ones I can pay off sooner. Thanks